25 Oct

Tunas Prima Got Awarded at Anugerah Investasi BP Batam 2024

Batam, October 24, 2024 – Tunas Prima Industrial Estate, a part of the Tunas Industrial Estate, was honored with the prestigious “Kawasan Industri Terbaru (Newest Industrial Estate)” award at Anugerah Investasi BP Batam 2024. The event took place on Tuesday, October 22, 2024, at Radisson Golf and Convention Center in Batam. The award was received by Albert, Director of PT Prima Propertindo Utama, in recognition of Tunas Prima’s significant contribution to industrial growth and investment in Batam.

In his remarks, Susiwijono Moegiarso, Secretary of the Coordinating Ministry for Economic Affairs, highlighted the vital role of investment in developing international-standard industrial zones and positioning Batam as a modern manufacturing hub in Southeast Asia. In the first half of 2024, Batam recorded an investment increase of IDR 12.31 trillion, growing 55.70% compared to the same period the previous year. This growth was further supported by export values reaching USD 14.6 billion and imports totaling USD 13.8 billion in 2023. These achievements reinforce Batam’s standing as one of Indonesia’s premier investment destinations.

“We are deeply honored to receive this award and proud to be part of Batam’s progressive economic development. We will continue to innovate and offer the best services as a preferred industrial estate for both national and international investors in Batam,” said Albert, Director of Tunas Prima.

Tunas Prima is the latest 100-hectare industrial zone under the Tunas Industrial Estate, offering modern facilities and eco-friendly infrastructure that is GREENMARK certified by the Building and Construction Authority (BCA) Singapore. It is also in the process of GREENSHIP certification from the Green Building Council Indonesia (GBCI). Strategically located in Kabil, Batam, Tunas Prima provides seamless connectivity for various industries, including manufacturing, logistics, and technology, along with one-stop business services to support integrated business expansion. For further information about Tunas Prima, please contact:

Muhammad Andika (Marketing Communication Tunas Group)

Phone Number: 0819-3365-4898

Email: [email protected]

22 Oct

Batam’s Labor Landscape: Unlocking Opportunities

Batam, strategically located near Singapore and Malaysia, is rapidly establishing itself as one of Indonesia’s foremost industrial and investment hubs. For businesses and investors aiming to penetrate Southeast Asian markets, a thorough understanding of Batam’s labor market, competitive wage structures, and regulatory environment is essential. This article explores the key elements that make Batam a compelling destination for business expansion.

A Dynamic Workforce Demographic

Batam’s workforce is youthful, skilled, and growing rapidly, with a labor force participation rate of 70%. Many workers are under 35, bringing energy and adaptability to industries like manufacturing and technology. The city’s industrial growth has developed a labor pool experienced in maintaining global standards, particularly in electronics, shipbuilding, and automotive sectors. This makes Batam an attractive hub for businesses looking to tap into Southeast Asia’s markets.

In addition to local talent, Batam attracts foreign professionals, particularly from Singapore, China, and Europe. These foreign workers bring specialized skills, contributing to high-tech and strategic industries. Their presence complements local talent, filling critical roles and enhancing Batam’s competitive edge in industries such as manufacturing and technology.

Key Industries Driving Employment

Manufacturing is the primary driver of Batam’s economy, employing the largest portion of the workforce. The electronics industry, in particular, has seen significant growth due to the city’s focus on technology-driven production. Other key sectors, like automotive and consumer goods manufacturing, also contribute to job creation and skill development for the local population.

While manufacturing remains dominant, Batam’s economy is diversifying into services, trade, and tourism. The growing hospitality and tourism sectors, fueled by visitors from neighboring countries, are creating new employment opportunities and expanding the city’s economic potential beyond its industrial roots. This diversification opens up new avenues for investors and businesses seeking to tap into Batam’s evolving landscape.

Competitive Wage Structure

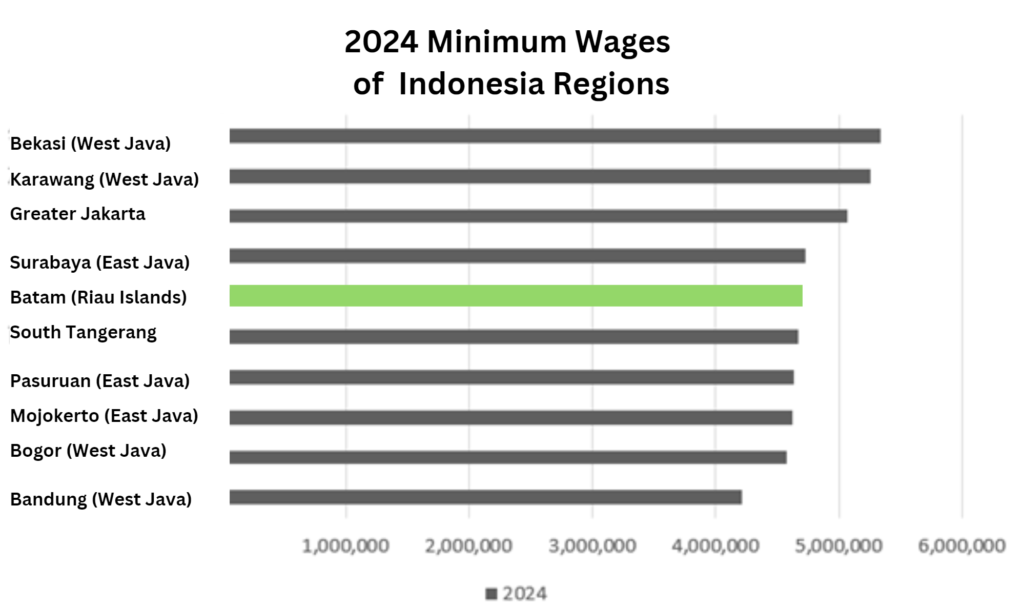

One of the key advantages of operating in Batam is its competitive labor cost. In 2024, the minimum wage in Batam was set at Rp 4,685,050 per month for a 40-hour workweek. This wage level strikes a balance between ensuring worker welfare and maintaining business competitiveness, allowing companies to access a productive labor force without the high operational costs often associated with major cities like Jakarta or Surabaya.

The minimum wage policy in Batam is shaped by various economic factors, including inflation, economic growth, and the cost of living. In 2024, the determination of the minimum wage has garnered attention as the government collaborates with labor unions to establish a fair wage that supports both employee welfare and the economic viability of businesses. This cooperative approach aims to foster a stable labor market while encouraging investment in the region.

When compared to other regions in Indonesia, Batam’s minimum wage positions it in the middle tier. For example, while DKI Jakarta’s minimum wage is higher at Rp 5,067,381 per month, regions like Bekasi City and Karawang lead the country with minimum wages reaching Rp 5,343,430. This ranking illustrates that while Batam offers competitive wages, it remains manageable for businesses, ensuring that the region continues to attract investment.

Workforce Regulations and Labor Protections

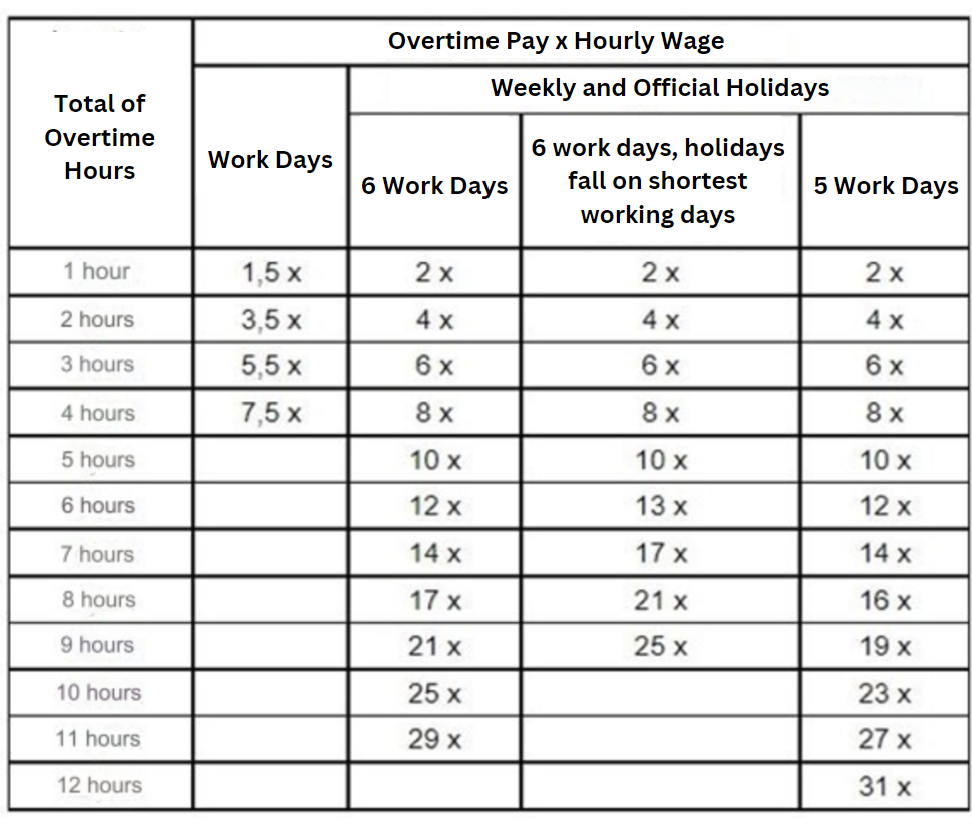

Indonesia’s labor laws are designed to protect workers while facilitating efficient business operations. Overtime work is regulated with specific calculations to ensure fair compensation, where overtime wages are based on an employee’s base salary divided by 173 hours for a standard work month. This clarity helps maintain worker satisfaction and productivity, providing stability for businesses.

In Batam, industries like electronics manufacturing and logistics often operate on a three-shift system to maximize productivity, typically consisting of three 8-hour shifts for 24/7 operations. Some companies may also use a two-shift system with 12-hour shifts over a 6-day workweek. To support night shift workers, businesses often provide incentives like snacks and drinks to help maintain their energy levels.

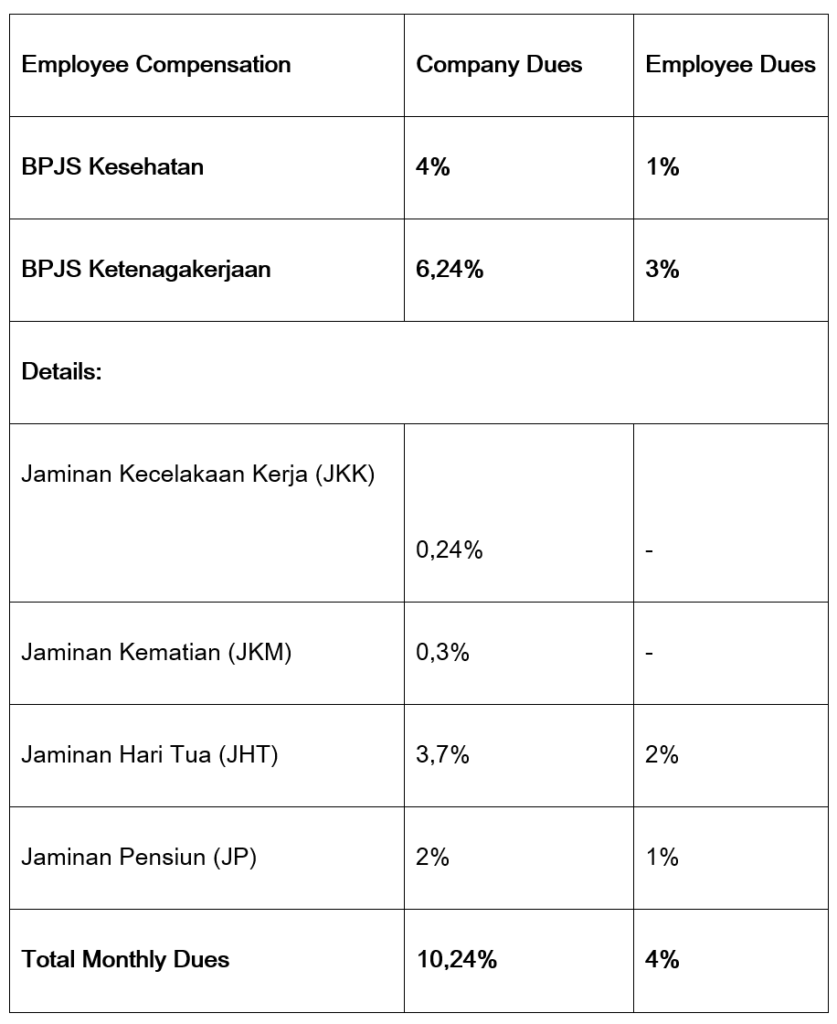

A crucial aspect of Batam’s labor environment is the comprehensive social security system managed by BPJS, which includes BPJS Kesehatan for health insurance and BPJS Ketenagakerjaan for employment protection. This system ensures workers have access to healthcare and support in case of workplace accidents, contributing to workforce stability.

Recruitment Trends and Talent Availability

Batam’s labor market is dynamic, with diverse recruitment channels for both blue-collar and white-collar job roles. For blue-collar positions, companies primarily utilize local job portals, social media, and HR outreach to attract skilled workers, reflecting the high demand in sectors like manufacturing, construction, and assembly. In contrast, white-collar recruitment, especially for managerial roles, often involves professional platforms like LinkedIn and headhunters, ensuring access to top-tier talent. For critical positions, companies may even recruit expatriates from their head offices to bring in specialized expertise.

A unique aspect of Batam’s workforce is its multilingual capabilities, particularly in Mandarin. Many locals possess basic Mandarin skills, which is advantageous for businesses engaged in trade with Mandarin-speaking markets, such as China. The presence of a sizable Chinese community and Mandarin language programs in schools enhance this linguistic skill among the population. This capability not only fosters smooth international business relationships but also positions Batam as a multicultural city ready to connect local workers with the global job market.

02 Oct

Downstream Industry Potential in Batam Attracts CNGR’s Interest in Investing

Batam continues to solidify its reputation as a prime investment destination with a recent visit from CNGR Advanced Material Co., Ltd., a leading Chinese company in the energy sector and a global supplier of lithium batteries. The visit on Friday, September 27, 2024, highlights the growing interest of international companies in Batam, particularly in the tin downstream industry.

As one of the world’s largest producers of tin, Indonesia holds significant potential to enhance its economic value through downstream processing. Tin-based products, such as electronic components, batteries, and other industrial materials, offer much higher export value. Batam, with its well-established and integrated industrial infrastructure, is perfectly positioned to become a key hub for such downstream industries. The city’s status as a Free Trade Zone (FTZ) also provides numerous incentives for companies looking to expand their operations in Indonesia. Its robust infrastructure, ease of import-export processes, and strategic location make Batam an ideal choice for multinational companies like CNGR.

CNGR Advanced Material has successfully expanded into markets across Europe, the United States, Japan, and South Korea. Following this success, CNGR is now considering Batam as its next strategic move. According to Zhu Jiangang, Vice President of CNGR Advanced Material, the company’s investment in Indonesia has already reached USD 7 billion and employed 8,000 workers. They are optimistic that this expansion will continue, with Batam’s downstream industry offering strong potential as the next investment destination.

During the meeting, Zhu Jiangang expressed his confidence in Batam’s promising market potential, noting the one-stop business solutions provided by Tunas Industrial Estate, led by Chrispin Andereas, which enhances the prospects for business growth. Zhu emphasized that Batam’s strategic location, streamlined import-export processes, and solid infrastructure were key factors driving CNGR’s interest in investing in the city. This aligns with CNGR’s ambition to continue its growth in the energy and downstream sectors, with plans to expand operations in countries such as Finland, Morocco, and Indonesia. Batam’s readiness to accommodate large-scale investments underscores its position as a leading industrial hub in Southeast Asia.